Kimberly White/Getty Images for Robinhood

- More than 1 million people have signed up for Robinhood's crypto wallet, CEO Vlad Tenev said.

- "A lot of people have been asking for the ability to send and receive cryptocurrencies," he told CNBC on Thursday.

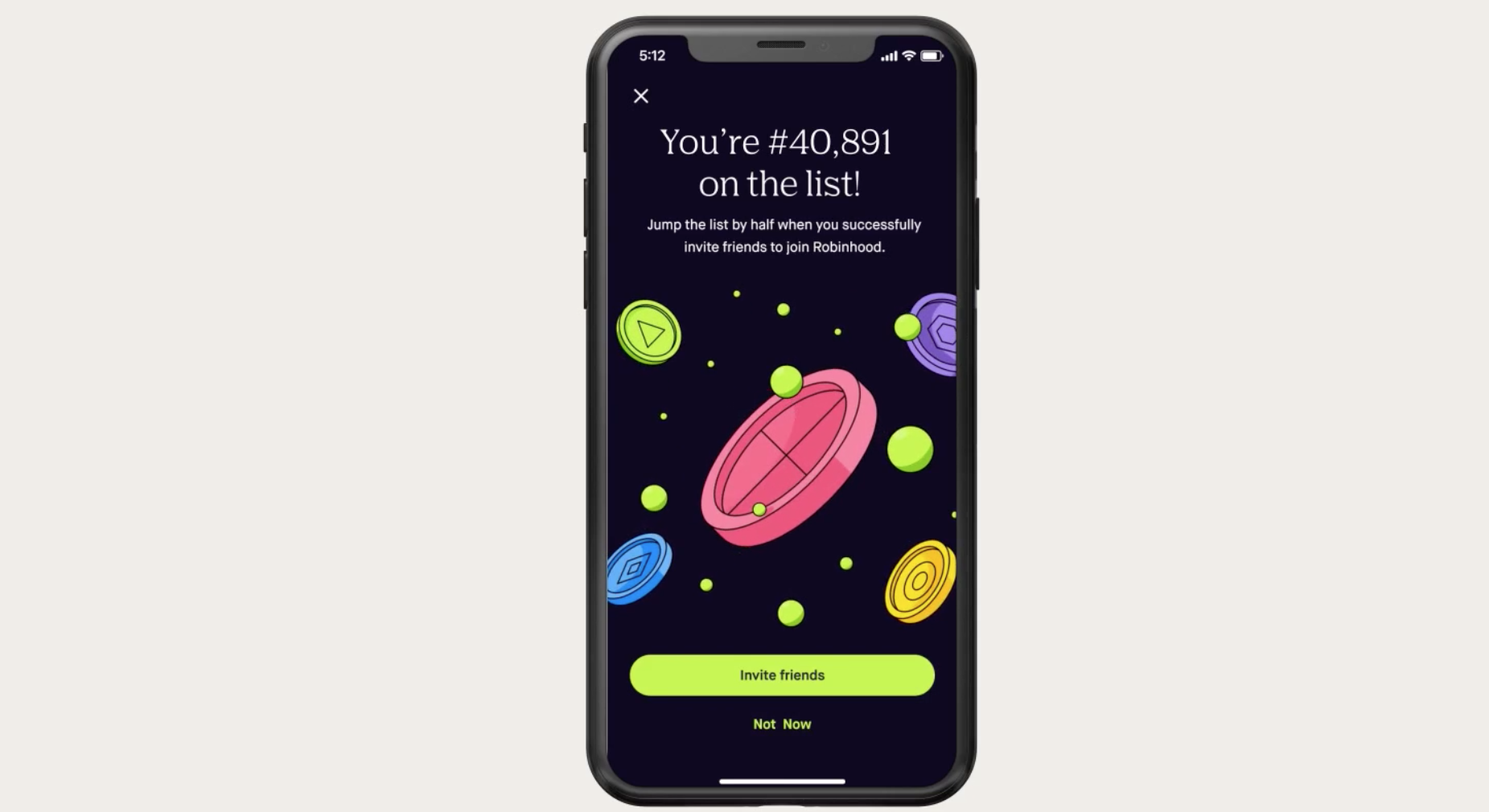

- Robinhood announced last month that it's testing the crypto wallet feature.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Robinhood's long-awaited cryptocurrency wallet, which launches early next year, already counts more than one million customers on its waitlist, CEO Vlad Tenev told CNBC on Thursday.

"We're very proud of our cryptocurrency platform and giving people more utility with the coins they have," he said at CNBC's Disruptor 50 summit.

"We rolled out our wallets waitlist. A lot of people have been asking for the ability to send and receive cryptocurrencies, transfer them to hardware wallets, transfer them onto the platform to consolidate and the crypto wallet's waitlist is well over a million people now."

Robinhood unveiled its crypto wallet service last month, saying it would first test the product based on user feedback in October before it goes to market. This feature would allow users to manage their crypto holdings within the app.

For now, the investing app offers seven types of digital assets, including bitcoin, ethereum, and dogecoin.

"You can have a wallet, you can send people cryptocurrencies from that wallet to their wallet," Tenev said. "There's certain advantages that are in the technology that make it kind of global and accessible by default and that makes it very interesting."

Robinhood launched crypto trading services in 2018 to expand its customer base and provide users with more access to functionality. Cryptocurrencies made up 50% of its transaction-based revenue in the second quarter this year, with dogecoin accounting for 62% of that figure, the company said.

Cryptocurrencies seem to have become a mainstream asset class as most investors continue to consider including such assets as part of a diversified portfolio.

Bitcoin hit a new peak this week, topping $66,000 for the first time ever. The digital asset gained momentum after the first futures-based bitcoin ETF launched in the US, the ProShares Bitcoin Strategy ETF.

"Looking ahead, the market will continue to be receptive, and we expect the ETF's price to remain in line with bitcoin's price trends," Du Jun, co-founder of crypto exchange Huobi told Insider. But its market share faces potential competition from competitor products such as Valkyrie, which began trading on Friday, he said.

"Premiums and fees may fall after the launch of other bitcoin futures ETFs," Jun said.

JPMorgan said Wednesday that bitcoin's recent gains have been driven by fears of inflation, rather than excitement around the ETF.

Robinhood is due to report its third-quarter results on Tuesday, October 26 after the bell.